rhode island tax table 2021

Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation.

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

This form is for income earned in tax year 2021 with tax returns due in April 2022.

. Find your income exemptions. We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated for tax year 2021. Instead if your taxable income.

However if Annual wages are more than 231500 Exemption is 0. You can download or print current or past-year PDFs of. Find your pretax deductions including 401K flexible account.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Tax rate of 375 on the first 68200 of taxable income.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. 2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Find your pretax deductions including 401K flexible account.

However if Annual wages are more than 231500 Exemption is 0. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. Rhode Island state tax 2693.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. The Rhode Island Division of Taxation today announced the standard deduction amounts tax. 2021 Rhode Island Tax Table.

Detailed Rhode Island state income tax rates and brackets are available on. Exemption Allowance 1000 x Number of Exemptions. Find your income exemptions.

2021 Rhode Island Tax Table. How to Calculate 2018 Rhode Island State Income Tax by Using State Income Tax Table. The income tax is progressive tax with rates ranging from 375 up to 599.

Tax rate of 475 on taxable income between 68201 and 155050. Tax rate of 599 on taxable income over 155050. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Compare your take home after tax and estimate. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet.

Apply the taxable income computed in step 5 to the following. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet.

Division also posts changes for certain items involving 2021 tax year. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

TAX 2650 13128 2650 Over But not over 2650 8450 Over 8450 375 475 599 These schedules are to be used by calendar year 2021 taxpayers or fiscal year taxpayers that. Income Tax Calculator 2021 Rhode Island 119500. STATE OF RHODE ISLAND DIVISION OF TAXATION ONE CAPITOL HILL - PROVIDENCE RI 02908 CIGARETTE DEALER LICENSE RENEWAL APPLICATION Due on or before February 1 2022.

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

State Taxes On Capital Gains Center On Budget And Policy Priorities

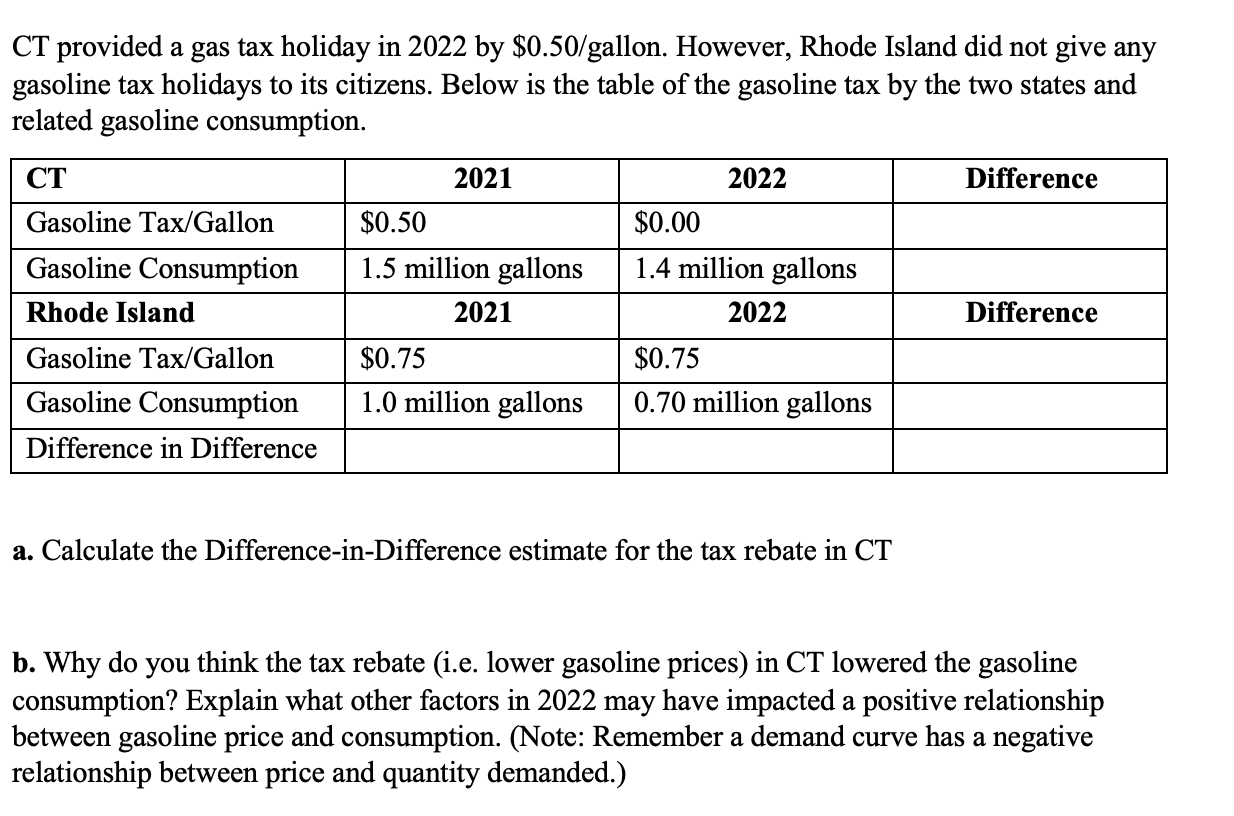

Solved Ct Provided A Gas Tax Holiday In 2022 By Chegg Com

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

Last Stretch To Get Your 1099 S Right The Dynamics Gp Geek Blog

State Income Taxes Updated For 2021 Moneytree Software

Taxation Of Social Security Benefits Mn House Research

Rhode Island Sales Tax Rate Rates Calculator Avalara

Payroll In Rhode Island What Every Employer Needs To Know

Pennsylvania Tax Rate H R Block

Basic Information About Which States Have Major Taxes And States Fiscal Years

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

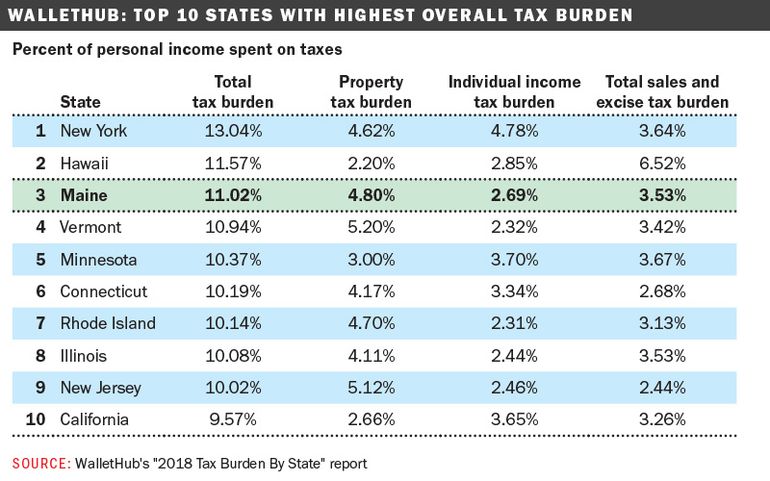

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

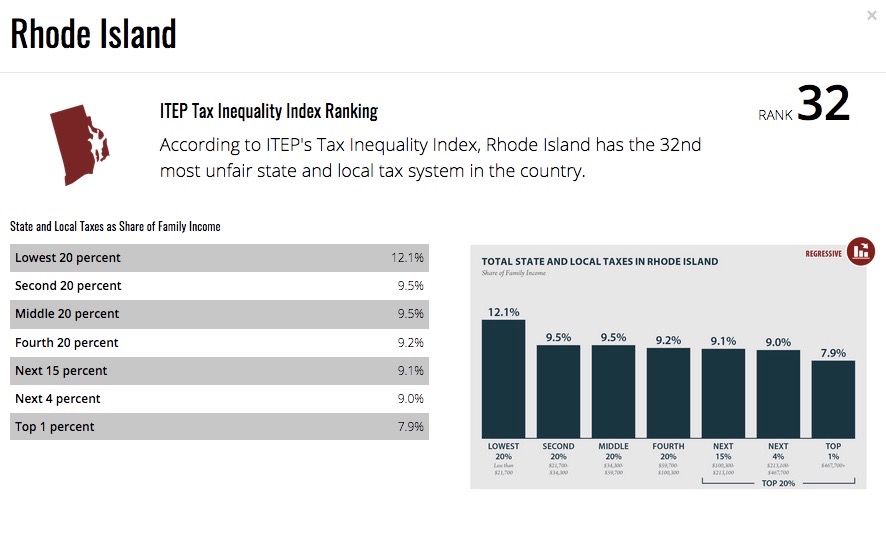

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

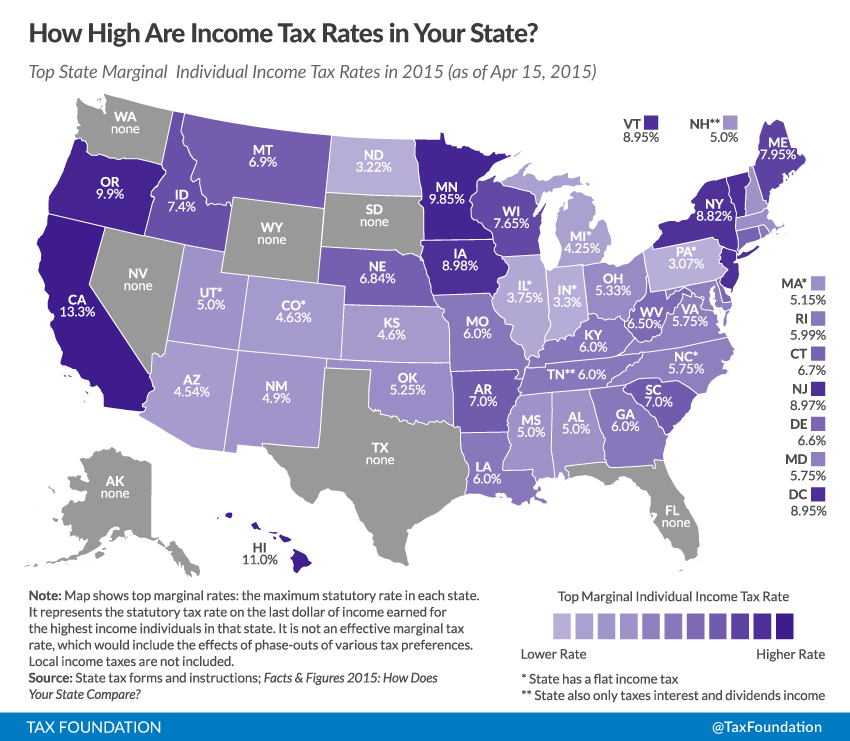

State Individual Income Tax Rates And Brackets Tax Foundation

Ri Health Insurance Mandate Healthsource Ri

Rhode Island 30 Towns To Decide On Marijuana Sales Measures This November Norml